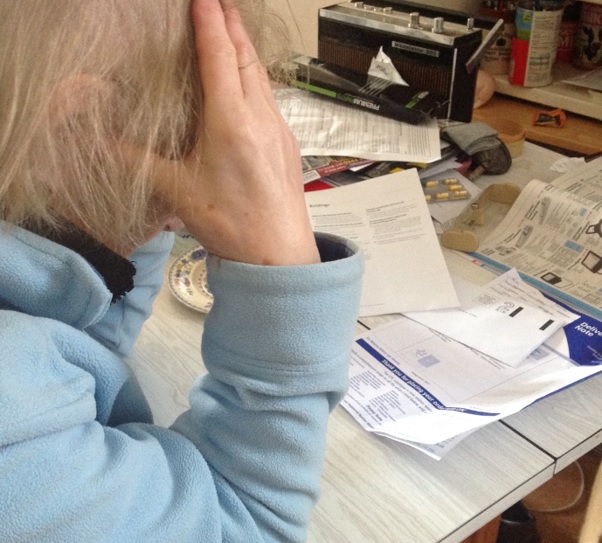

Financial services provider Leeds Credit Union has launched a new initiative to help its members consolidate their debts and lower their monthly outgoings.

By making £1 million available to its 37,000+ members across Leeds and other areas, plus residents of associated housing associations and select employers, Leeds Credit Union hopes to help them tackle the cost of living crisis by stopping them overpaying on interest for store cards, overdrafts, credit cards and high interest loans.

The organisation has taken the decision in response to feedback from its members who revealed last month that 48% of them were unsure how they would afford Christmas, raising concerns many would turn to high interest loans or rack up credit card debt.

Leeds Credit Union has a branch at Armley One Stop Centre, Stocks Hill, which opens Monday to Friday, 9am to 3pm.

Stephen Porter, Head of Member Experience at Leeds Credit Union, said:

“With the cost of living crisis continuing to affect communities across the region, many households are falling into debt, often to multiple lenders.

“Making a significant amount of money available to our members so they can consolidate their debts makes it easier for them to pay off their existing debts in one easy, monthly payment. Because we offer lower interest rates than most other lenders, our debt consolidation package also helps members reduce their interest payments, further improving their financial situation.

“To try and make 2023 less financially stressful for our members, we’ve also launched this year’s Christmas Club saving account. This means they can start saving for Christmas 2023 today, gradually building up a pot throughout the year rather than having to try and find money in a mad rush come December. Savings will be available from 1 November.”

To apply for a debt consolidation loan, members can visit one of Leeds Credit Union’s highstreet branches or the company’s website at: www.leedscreditunion.co.uk/loans/debt-consolidation-loans.